Now Reading: How Small Businesses Can Stay Ahead with Efficient Financial Planning

-

01

How Small Businesses Can Stay Ahead with Efficient Financial Planning

How Small Businesses Can Stay Ahead with Efficient Financial Planning

Successfully navigating the competitive and ever-evolving business landscape requires small businesses to plan financially with unmatched precision. Strategic financial planning is not just about keeping the lights on—it’s about creating a business environment that is resilient in the face of adversity, agile in shifting markets, and positioned for sustainable, long-term growth. Getting financial planning right can mean the difference between a small business just scraping by and one that is able to weather storms and seize opportunities as they arise. By shaping a tailored approach to their financial strategies, small business owners can tap into top industry expertise, such as guidance from top tax accountants in Chicago, ensuring their operations are financially sound and flexible enough to ride out market fluctuations. Taking this proactive approach means that business leaders position themselves not only to respond to challenges but to capitalize on new trends and navigate complex regulations with confidence.

Balancing daily expenses while preparing for long-term growth aspirations can seem overwhelming, especially for owner-operators who already wear multiple hats within their organizations. However, building efficient financial planning systems in your business creates a clear roadmap for daily operations and long-term success. Importantly, effective financial planning is about far more than just annual budgeting or monthly expense tracking—it involves embracing the latest digital tools, securing diverse types of funding, and making thoughtful, informed, and forward-thinking choices at every turn. Businesses that continuously improve their planning processes, even incrementally, are more resilient to disruption and are better equipped to thrive in periods of uncertainty and expansion. Even minor enhancements in how a company manages its finances can result in a dramatic shift from mere survival to robust, confident growth.

Separate Business and Personal Goals

One of the most common and potentially damaging pitfalls for small business owners is the failure to separate personal and business finances. This blurred line can create not only confusion for the business owner but also complications for potential investors, lenders, and even tax authorities. When bank accounts, expenses, and investment strategies overlap, it becomes challenging to assess the true financial health of the business, which can jeopardize legal protections such as limited liability. Establishing and rigorously maintaining distinct financial goals and accounts for business and personal needs not only protects essential working capital but also introduces much-needed discipline into daily financial activities. This clear delineation helps ensure that personal withdrawals don’t inadvertently drain resources necessary for business operations, and fosters more level-headed, professional decision-making. With well-defined boundaries, business owners can craft resource planning that is organized, targeted, and aligned with growth goals—allowing for confident, data-driven strategies that are more appealing to partners and regulators alike. Additionally, separating finances streamlines tax reporting and paves the way for clearer financial performance metrics, which in turn support future planning and analysis of growth.

Explore Funding Options

To grow and scale, businesses often need more than what can be generated from internal profits or owner contributions alone. The modern business environment rewards those who seek out and explore diverse sources of capital—including small business loans, state and federal grants, business incubators, and angel or venture investors. Widening your net for funding not only increases the funds available for technology upgrades, hiring, or market expansion but also cultivates relationships with a broad range of financial backers, which can open doors later on. By building a diverse array of financing options, companies insulate themselves against financial turbulence or shifting market conditions that could otherwise delay important initiatives. According to the U.S. Small Business Administration, businesses using multiple funding sources tend to report higher survival rates and stronger growth trajectories. By routinely assessing your eligibility for business grants or new lending instruments, entrepreneurs ensure that they remain nimble and financially prepared to invest in future opportunities. Maintaining open lines of communication with lenders, seeking grant-writing assistance, and monitoring industry-specific funding streams can bring added security and innovation, ultimately fueling your company’s lasting success.

Monitor Cash Flow Regularly

Cash flow truly is the heartbeat of small business sustainability. The ability to stay attuned to day-to-day liquidity often determines whether a business is merely paying bills or setting aside funds for expansion and innovation. Regular, comprehensive reviews of receivables, payables, and overall liquidity allow businesses to not only detect patterns but also to forecast seasonal slowdowns or anticipate cash crunches well in advance. By utilizing robust accounting software or engaging a professional bookkeeper, small business leaders can generate up-to-date cash flow statements, balance sheets, and performance reports, which greatly aid in proactive and informed decision-making. Monitoring financial metrics, such as accounts receivable turnover, the ratio of quick assets to current liabilities, or the average time required to collect payments, helps a business avoid being blindsided by cash shortages. This vigilance ensures your business can always meet obligations such as payroll and rent, while also identifying the right moments to capitalize on attractive discounts, invest in new equipment, or pursue new markets.

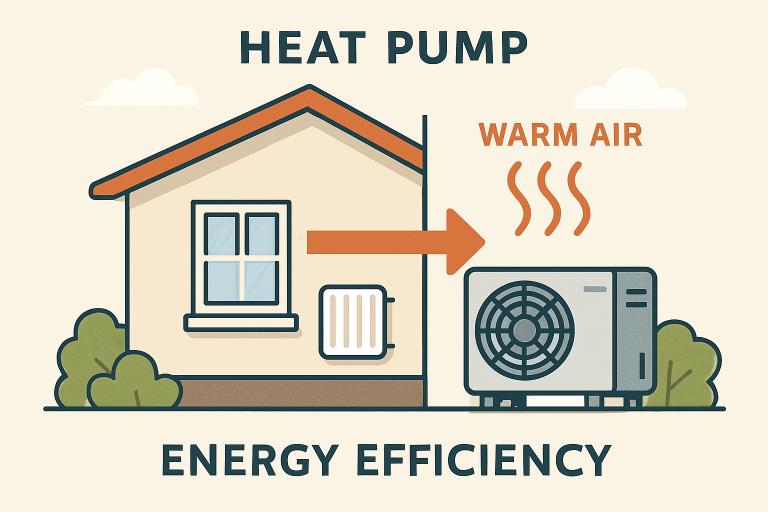

Leverage Digital Tools

Embracing digital transformation has shifted from a competitive advantage to a necessity for businesses seeking both efficiency and accuracy. Modern cloud-based expense management and accounting platforms provide real-time visibility into financial data and automate routine transactions, thereby minimizing the likelihood of human error and significantly reducing operational costs. As business finance grows more complex, automation helps ensure compliance with regulatory requirements while providing enhanced insight for decision-makers. According to a recent Intuit QuickBooks survey, small businesses with professional accountant support are 59% more likely to adopt technology such as artificial intelligence, automating everyday bookkeeping and financial workflows. These tools don’t just streamline back-office operations—they grant owners unprecedented control and visibility over business performance. When comparing different payroll systems, invoicing solutions, or fully integrated financial management suites, business owners should regularly review and adopt solutions that best match the unique needs and goals of their company.

Build a Financial Safety Net

Economic downturns, industry disruptions, and unexpected expenses are ever-present realities for today’s business owners. Building and maintaining a financial safety net—most often in the form of a robust business emergency fund—can provide critical support when times get tough. Financial advisors universally recommend setting aside a percentage of profits on a regular basis, with the goal of eventually reaching a reserve that can cover three to six months of average operating expenses. This “rainy day” fund acts as a cushion when sales slow, unexpected repairs arise, or a key customer invoice is delayed. In tandem with developing an emergency reserve, it’s essential to periodically review and update all insurance coverages, including business interruption, liability, and property policies. Together, these two pillars of financial safety can mean the difference between weathering adversity and facing permanent closure. For many small businesses, the assurance of a financial buffer enables more confident investment in growth initiatives, providing security in the knowledge that setbacks won’t result in an immediate existential threat.

Adopt Strict Cash Flow Management Strategies

Monitoring cash flow is essential, but savvy small businesses must also implement advanced cash management tactics to maintain strong liquidity. This can include negotiating longer payment terms with suppliers while simultaneously incentivizing clients to pay sooner, optimizing the inflow and outflow of money to minimize gaps. Utilizing sophisticated budgeting tools enables the tracking of actual results against financial forecasts, facilitating the quick identification and correction of negative trends. Furthermore, keeping cash reserves active—such as by placing idle funds into interest-earning business savings accounts—helps businesses maximize financial returns on their capital without sacrificing access to necessary resources. This heightened management discipline ensures that companies are well-positioned to make prompt investments, capitalize on unexpected business opportunities, and manage emergency expenditures with minimal disruption.

Embrace Remote and Hybrid Work Models

The rise of remote and hybrid work has fundamentally transformed traditional business cost structures, particularly for small organizations in competitive markets. By reducing their reliance on expensive physical office space, companies can immediately decrease ongoing costs related to rent, utilities, office supplies, and even employee commuting subsidies. Not only do these savings directly impact the bottom line, but studies also show that remote and hybrid models can increase employee satisfaction, leading to higher retention and improved productivity. For many businesses, flexibility in work arrangements opens the talent pool to a broader geographic area and creates a more agile business model better suited to evolving markets. Leaders should regularly review their workforce policies to ensure they’re leveraging the financial and operational benefits of these modern arrangements, maximizing both cost savings and human capital returns.

Enhance Financial Literacy

A business’s long-term strength is inextricably linked to the financial knowledge and expertise of its leadership team. Committing to ongoing education—whether through workshops, webinars, online programs, or certification courses—expands the capacity of owners and managers to understand, forecast, and quickly react to the ever-changing financial environment. Improved financial literacy enhances your ability to negotiate assertively with investors and lenders, make smarter resource allocation decisions, and run a sustainably profitable operation. It also fosters compliance with regulations, increases transparency in communication with financial institutions, and helps unlock additional sources of support and funding.

By embracing modern financial planning strategies, incorporating digital efficiencies, and making a steadfast commitment to improvement through education, small businesses secure long-term stability and find themselves well-positioned to outpace the competition—even as markets shift and uncertainties arise. The path to financial health may be complex, but with careful planning and disciplined execution, lasting success is within reach.