Now Reading: What Happens After You Accept a Cash Offer on Your House

-

01

What Happens After You Accept a Cash Offer on Your House

What Happens After You Accept a Cash Offer on Your House

Key Takeaways

- Cash offers close faster (7–14 days) with fewer risks and no lender delays.

- Review all contract terms in writing before signing.

- Earnest money (1–3%) shows buyer commitment and applies to the sale price.

- Inspections may still occur; appraisals are optional.

- Title/escrow services handle legal checks, funds, and document transfers.

- Closing day finalizes paperwork, releases payment, and transfers ownership.

- After closing, vacate, settle utilities, and keep records.

What Accepting a Cash Offer Means

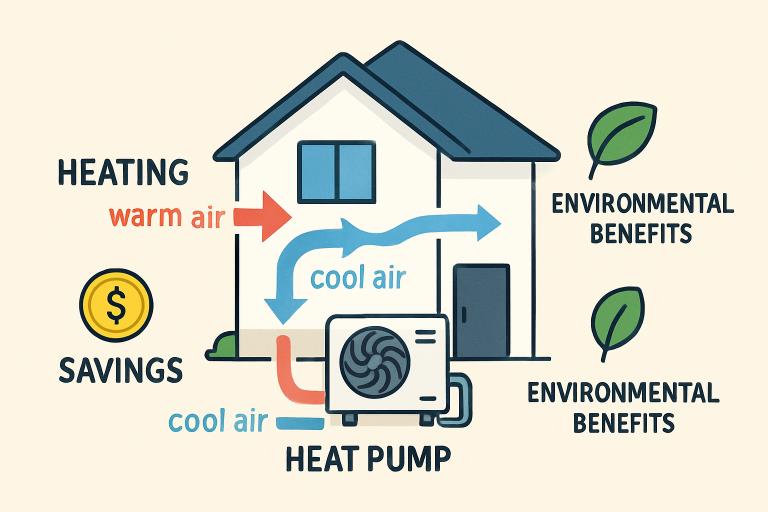

Accepting a cash offer on your house can be a game-changer compared to the standard selling process. A cash offer in real estate means the buyer intends to pay the full purchase amount upfront, without needing a mortgage or other financing. This approach can lead to fewer uncertainties and a streamlined closing process. Unlike traditional offers, cash offers don’t depend on lender approvals, underwriting, or appraisals required for loan approval, which often extend timelines and introduce stress. Sellers are increasingly attracted to cash buyers because the process tends to be faster, simpler, and carries a lower risk of falling through due to financing issues. Companies known as property buyers have become popular partners for homeowners looking for quick, secure sales with minimal hassles.

Getting Started: Reviewing Paperwork and Contracts

Immediately after accepting a cash offer, the next step is to review and sign the purchase agreement. This contract will outline all terms of the sale and contingencies and clearly define both parties’ responsibilities. Documents you’ll encounter include the purchase contract, disclosures about the property, and various legal addenda specific to your location. Carefully examining each document is crucial. Consult with your real estate agent or hire an attorney to ensure you fully understand all clauses. Ensure all changes or agreements discussed verbally are included in writing and scrutinize details such as deposits, closing date, and included fixtures.

The Role of Earnest Money Deposit

Buyers provide an earnest money deposit in most real estate transactions, including cash sales. This deposit is a show of good faith, typically ranging from 1% to 3% of the home’s sale price, and is held in escrow until closing. It protects sellers by giving assurance that the buyer is serious, and, for buyers, it secures their right to purchase the home as outlined in the contract. The deposit is usually applied toward the purchase price at closing. The earnest money deposit is typically made a few days after contract acceptance. If either party fails to meet its obligations, the earnest money may be forfeited according to the agreement.

What to Expect During Home Inspections and Appraisals

Although lender requirements don’t bind cash buyers, many still opt for a home inspection to assess the property’s condition and identify potential repairs. These inspections protect the buyer and occasionally prompt last-minute negotiations if any major issues are discovered. Appraisals typically required for financed offers may be skipped in a cash deal unless a buyer requests one for personal assurance. Skipping the appraisal and loan approval steps leads to a much faster transaction and is one reason sellers value working with property buyers.

Working With Title and Escrow Companies

Title and escrow companies act as neutral third parties to facilitate the transfer of ownership. They verify the legal status of the property (searching for liens or title issues), hold funds in escrow, and ensure all contract conditions are met before funds and keys change hands. Both buyer and seller will provide the necessary documents to the title company. Delays can occur if there are issues like unpaid taxes, outstanding liens, or disputes over property boundaries. Working with reputable professionals who understand the local market can help efficiently prevent and resolve these potential obstacles.

Closing Timeline and Expected Steps

One of the main advantages of a cash sale is the speed with which it can close. Without lender requirements, most cash transactions close within 7 to 14 days, though some may stretch to three weeks depending on title and escrow timelines. Typical milestones in the cash sale process include contract finalization, earnest money payment, inspections, title search, and final walkthrough. Sellers should use a checklist to prepare for closing: cancel utilities, change mailing addresses, and ensure the home is clean and empty for the new owners. For sellers wanting an easy process from offer acceptance to closing, working with experienced cash buyers can streamline each step.

What Happens on Closing Day

Closing day marks the official transfer of ownership. The buyer usually conducts a final walk-through to ensure the property’s condition matches the agreement. Both parties will meet (or sign remotely) to complete necessary documents: the deed, closing statement, and affidavits. The sale is complete once all paperwork is signed and funds are transferred through escrow. Sellers will receive payment—often within hours—and the buyer will become the new official owner. Be sure to bring identification and any required keys or remotes for the property.

After the Sale: Final Steps for Sellers

After closing, sellers are expected to vacate the property according to the contract’s agreed-upon timeframe. This includes turning off utilities, canceling or transferring homeowner’s insurance, and notifying relevant parties of your address change. It’s also important for sellers to keep a record of the transaction documents, as these may be necessary for tax purposes or in case of future legal questions.

Frequently Asked Questions

How soon do you get paid from a cash sale?

Typically, sellers receive their proceeds on closing day or within one business day once all funds clear through escrow.

Are there still closing costs with a cash sale?

Yes, sellers are usually responsible for some closing costs, such as title insurance, escrow fees, and prorated property taxes, but costs are often less than with financed sales.

Can a cash buyer back out of the agreement?

While less likely than with mortgage financing, a cash buyer can still exit the deal based on contract contingencies (such as inspection results). Depending on the terms, the earnest money deposit may be forfeited. Check major real estate sources for more details about contingencies and seller protections.